Growth sector analysis: Skilled workforce meets investment opportunities

In our last edition we provided a snapshot overview of the local economic landscape and how it has changed from the 2016 until the 2021 census.

Today we are zooming in on one of the fastest growing industries, the Transport, Postal and Warehousing sector.

All data referenced in this article and illustrated in the tables below is sourced from: The Australian Bureau of Statistics, Census of Population and Housing, 2021 Compiled and presented in economy.id by .id (informed decisions).

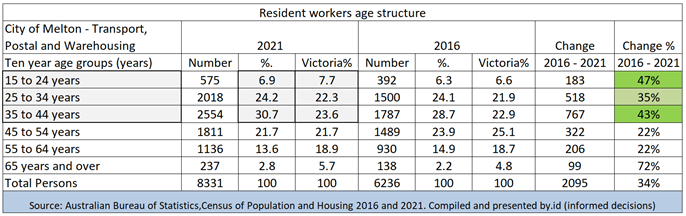

The age structure of the City of Melton's resident workers is indicative of the skill-levels and experience that local businesses can draw upon. For example, younger resident workers, while less experienced, are typically more mobile and have higher level skills in new technologies.

The table below shows how the Transport, Postal and Warehousing sector, with its fast pace and ever increasing technology and digital data integration, is well aligned to be supported by and can draw upon, the City of Melton’s young population profile.

Overall, 61.8% of the resident workers in Transport, Postal and Warehousing were aged under 45 years, compared to 53.6% for Victoria. The increase in the under 45 years age bracket showed the highest growth with the exception of the 65 years and older bracket that grew by 72%. This may reflect the trend towards later retirement and most likely contains a relatively small proportion of new hires.

A skilled and experienced workforce

It is worthwhile noting that whilst 8,324 of the City of Melton’s total workforce of 81,439 are employed by organisations in the Transport, Postal and Warehousing sector, the sector only provides 2,282 jobs via local employers (to both residents and to people residing in other LGAs).

The low local jobs to sector employment ratio, or high local jobs gap, means that organisations from this sector that are planning to invest in Melton, can tap into a workforce that has relevant and current experience from similar roles within organisations based outside the City of Melton.

As living and working local is becoming increasingly more important for many people, both due to a rise in transport costs and a general trend towards finding the right work-life balance, any new transport and logistics enterprise will be able to pick from a large pool of skilled applicants as they establish local distribution centres.

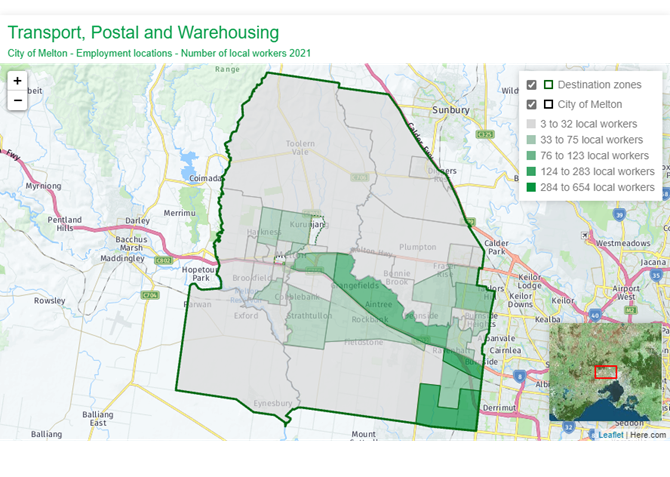

Job location overview

To date most jobs in this rapidly emerging sector are based in the south-eastern part of our municipality as this corridor offers good freeway access and linkages to ports and is also in proximity to future infrastructure projects such as the Western Interstate Freight Terminal (WIFT) and the Outer Metropolitan Ring Road (OMR). For more information on the WIFT, its benefits and to add your voice to our advocacy campaign please visit: Western Intermodal Freight Precinct website.

The Horizon 3023 precinct, situated to the south of the Western freeway and north of Christies Road next to Caroline Springs Station, has been a major driver of new jobs in the logistics and distribution sector attracting global brands such as Amazon, HelloFresh, Electrolux and major national organisations such as Myer, Mitre 10 and Scalzo Foods. The estate, developed by Dexus, will continue to expand and in conjunction with development along Hopkins Road, such as Melbourne Business Park, we can expect thousands of additional jobs being added to this sector in the years to come.

High value employment opportunities

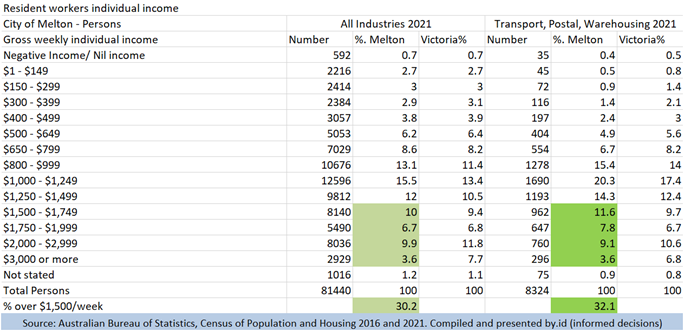

When comparing income bracket data we can see that the Transport, Postal and Warehousing sector, in comparison to “All Industries” data, shows a higher percentage of its workforce earning more than $1,500 per week.

This can be partly attributed to higher than average entry level wages that reflect the industry’s push to keep up with demand for customer orders. The relatively high wages may also recognise the fact that many roles in modern distribution centres now require a higher level of software or computer literacy, as autonomous moving robot technology and software and data interfaces are becoming part of almost any task. As a result the industry needs to attract higher skilled workers that are able to operate within more complex and continuously evolving systems.

Robotic assistance used at eStore Logistics distribution centre

Another contributing factor to the high total earnings for workers in this industry comes from the high volume of goods being processed and the resulting high volume of total work hours that these companies can offer.

Overall, only 25.2% of the resident workers in Transport, Postal and Warehousing worked part-time 2021 (34 hours or less) and 73.0% worked full-time (35 hours or more), compared with 31.8% and 66.7% respectively for Victoria.

Source: Australian Bureau of Statistics, Census of Population and Housing 2016 and 2021.Compiled and presented by .id (informed decisions)

We will continue to follow this sector closely over the coming years and look forward to introducing you to the new organisations from within this industry and from other sectors, as they choose to invest in Melton and become part of our thriving local economy.

In the meantime you can find more information on City of Melton employment statistics and general economic and community demographics data on the economy.id website.

Note: Census employment figures are known to undercount employment by varying amounts depending on the Census year. All Census counts are an undercount of total population, and in addition, some people don’t state their workforce status or industry. Also counts by place of work exclude those with no fixed workplace address. For this reason, it is recommended that for total job numbers, users look at the Employment by industry (Total) modelled estimates which are updated on an annual basis and based on the ABS Labour Force survey, less prone to undercount. The Census counts by industry are included on economy.id for a greater level of industry detail (3-digit ANZSIC).