5 Golden Rules to Minimise Your Taxes

Managing your business and personal life requires thinking at least two years ahead about what your plan is.

For example if your goal is to sell your business, get finance or refinance, there may be a good reason not to minimise your tax.

If you are looking to sell the business, get finance or refinance in the next two to three years, those evaluating the sale or loan application want to see at least two years of financials and tax returns. In these instances it may lead to a better outcome not to pursue a tax minimisation strategy

For most businesses however it is desirable to look ways to minimise your tax obligation.

Here are the five golden rules we recommend to reduce your 2019/2020 taxes:

Rule 1: Check You’ve Accessed all Eligible Assistance Available Due to the COVID-19 Crisis

If you have been impacted there are many schemes and packages out there that can help you reduce your expenses such as rent, incentive schemes from local, state and federal governments and new government guaranteed funding as well as loan assistance packages from banks and other financial institutions.

Go to our website for a comprehensive list of what is available.

Rule 2: Be Organised

For minimising your tax, the key is always to be organised. That is why we ensure our clients use a system like Xero and other apps to aid them. This allows them to ensure everything that hits their bank accounts or credit cards is recorded automatically and along with Hubdoc keeps copies of all tax invoices and receipts and can even read their invoices and process them into Xero.

Our clients have all their records in one spot, fully backed up at all times with NO risk of losing any valuable piece of information. The benefits to our clients are:

we are all using the one source of data which allows us to more proactively monitor the business;

if they are audited by the ATO they are at less risk;

they claim every expense allowable, nothing is missed or forgotten; and

it reduces their workload as the system does about 70% of the work.

Rule 3: Ask Questions

A business owner is not expected to know everything. Smart business owners know their limitations and get advice to help them fill in the blanks. Our job as Tax and Business Advisors is to make sure business owners make informed decisions. So if you are not sure, ask the question.

Don’t make decisions without having all the facts. A prime example with our clients is when they obtain new vehicle or equipment finance. Purchasing the asset with the wrong type of finance and in the wrong entity can have devastating consequences on the tax deductible and the risk to that asset.

Rule 4: Have the Right Structure

In Australia we have a number of different tax rates which allows us to distribute profits to minimise taxes at the lower rates. The structures we have that are commonly used are:

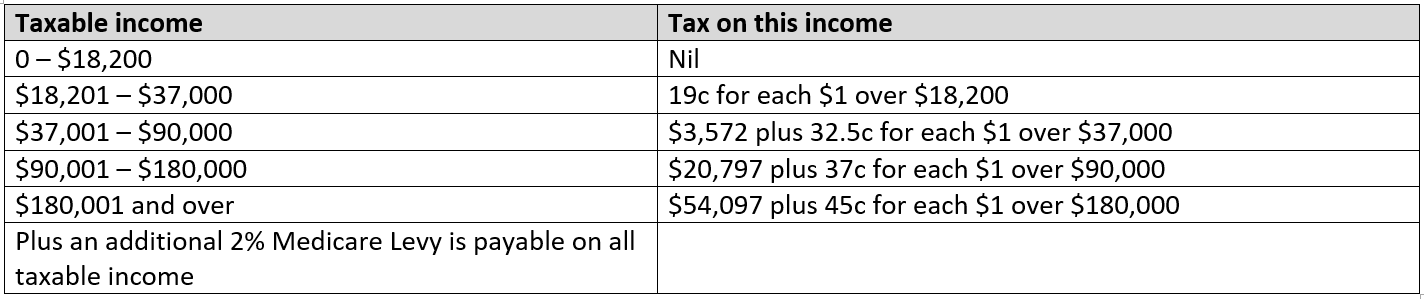

Sole Trader – where you are taxed as an individual (see below)

Partnership – where profits are split to individual partners and you are taxed as an individual (see below)

Company – where SME profits are taxed at 27.50%

Trusts – where profits are distributed to beneficiaries and if they are individuals are taxed as per the rates below or a company at the company tax rates

Individual Australian Residents Tax Rates

Compare these rates to that a small business company pays of 27.5%. Depending on which personal tax bracket you are in, it may result in less tax being payable if income is left or distributed to a company.

Some business structures allow this to occur much easier than others.

Rule 5: Reduce Your Profits

There are legitimate ways in which you are permitted to minimise tax. Part4A Tax Avoidance Provisions are used by the ATO to punish businesses and people avoiding tax, so keep in mind there is a major difference between illegal Tax Avoidance and legitimate Tax Minimisation.

a) Superannuation

The easiest way to minimise tax is to contribute money into your superannuation. You are allowed to contribute up to $25,000 extra per annum per person as well as any unused limits from prior years starting with 2018/19.

For example, if you contributed only $15,000 to superannuation last financial year, this year you can contribute $35,000 resulting from this financial year’s $25,000 and $10,000 not used last year.

b) Instant Asset Write Off

The Instant asset write off limit businesses can claim has been increased to $150,000 per asset up to 31 December 2020. This means if you acquire an asset up to that value, you claim the entire value as a deduction in the financial year it was acquired and available for use in the business.

Please note for motor vehicles, luxury car limits apply meaning you can only claim up to $67,525 for normal vehicles and $75,526 for fuel efficient vehicles.

We always caution our clients not to acquire an asset purely for the tax benefit, as the tax benefit is well short of the cost of the asset itself.

If you are financing the purchase speak to your accountant on the tax consequences of your different options and how to acquire the asset. The wrong decision here can cost you plenty of money and put the asset at risk if certain events occur.

c) Deferring Invoices

Defer sending invoices out to customers until the 1st July or have customers pay you after 30 June are both ways that can assist with reducing your taxable income in the current financial year.

d) Prepaying Expenses

Paying your business expenses or loan interest prior to 30 June allows you to claim those expenses in the current financial year and reduce your tax. If you want to prepay your loan interest speak to your financial institution first.

End of Financial Year reporting obligations

Financial Year’s end also brings many other obligations for business owners and we have listed some common one’s below. If you have followed our rules above, they should be relatively straightforward for business owners and your accountant to comply with.

Single Touch Payroll (STP)

For many small business owners this is the first year of the STP system. STP is the new reporting system where you report to the ATO an employees’ payroll information after each pay run. As part of the year end process, instead of issuing PAYG Summaries (Group Certificates) now a business has to finalise its STP with the ATO.

Before you do finalise your STP it is important that your reported wages are correct, and they match your W1 and W2 lodgements on your BAS Returns.

If you are not sure ask your Accountant to check it for you before it is lodged. Please keep in mind this needs to be done by the 14 July.

This information then flows through to your employees’ MyGov Accounts as well as their accountants can access that information of the ATO Tax Agent Portal’s Taxpayers Prefill Report.

While you are no longer required to issue your employees a PAYG Summary, it may be worthwhile considering providing it anyway as a goodwill gesture, as some employees do find it hard accessing their MyGov Accounts.

Taxable Payments Annual Reports (TPAR)

Businesses in the Construction, Transport, Cleaning and IT sectors may have a requirement to lodge your TPAR by the 28th August. This is a report to the ATO regarding which sub-contractors you paid during the year. The report includes the following information:

Name

Address

ABN of the sub-contractor

Gross Amount Paid

GST Paid

Workcover Wage Certification

WorkSafe Victoria require you to certify the wages and other benefits paid to employees. The due dates are usually in October for business with over $200,000 pa remuneration or March the following year for businesses with remuneration under $200,000 pa.

Job Keeper impacts on Workcover

Jobkeeper may affect what wages you are require to report.

Two aspects of Jobkeeper are excluded from wages for workcover purposes:

Any Jobkeeper top ups, where any employee was normally paid under the $1500 per fortnight and their income was increased to $1500, the top up portion of their wage is exempt from WorkCover. For example, if Todd was paid $1200 per fortnight prior to Jobkeeper, the additional $300 per fortnight paid to bring him up to $1500 per fortnight, is excluded

If an employee was laid off and received Jobkeeper, their full subsidy of $1500 per fortnight is excluded from Workcover contributions. For example, Sally works in a Gym that was closed but continued to be paid, her entire wage subsidy of $1500 per fortnight is excluded from Workcover contributions.

Payroll Tax

Businesses large enough to be liable for payroll tax are required to lodge their annual reconciliation by 21 July. Even though any payroll tax liable for 2019/20 financial year has been waived by the Victorian Government, you still have to lodge your return.

Article prepared by:

Michael Kirby

Managing Director, XO Accounting

XO Accounting was the winner of the 2019 City of Melton Business Excellence Awards: Best Professional Services Business Category.

Disclaimer: Your individual circumstances may differ, so always seek your own independent financial advice.